Poppo Live Agency Payout 2026: Best USDT Withdrawal Times

Buffget

2026/02/20

Understanding Poppo Live Agency Payout System in 2026

Agencies accumulate points based on host performance. Points convert to USD at 10,000 points = $1 USD, trackable real-time through your dashboard.

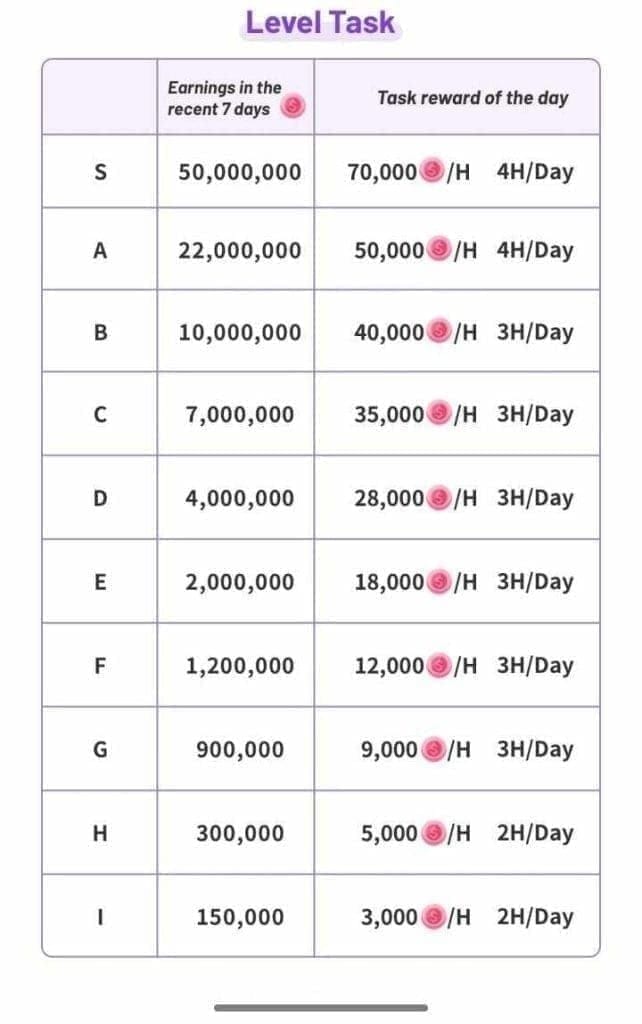

Commission rates scale with volume:

- Level D (0-2M points): 4% party, 30% match/chat

- Level C (2-10M points): 8% party, 35% match/chat

- Level B (10-50M points): 12% party, 40% match/chat

- Level A (50-150M points): 16% party, 45% match/chat

- Level S (150M+ points): 20% party, 50% match/chat

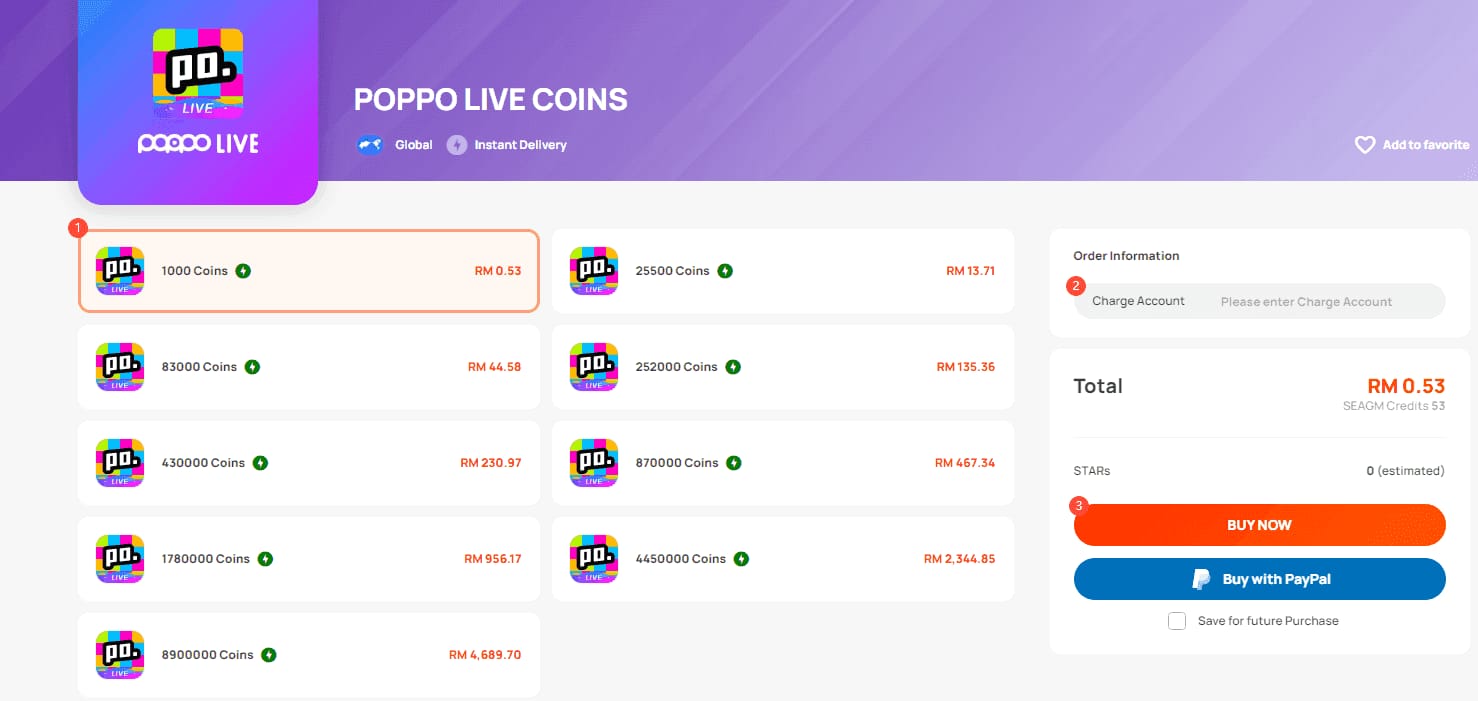

For host support, buffget offers convenient Poppo Live coins top up with competitive pricing and secure transactions.

How Agency Points Convert to USDT

Points accumulate weekly, finalizing Sunday 23:59 UTC+8. Minimum withdrawal: 100,000 points ($10 USD). Recommend maintaining 110,000 points to avoid Error 1001.

USDT TRC20 wallet addresses must start with T and contain exactly 33 alphanumeric characters. Network confirmations require 19 blockchain validations before funds appear—adds 40-60 minutes to processing.

February 2026 Payout Updates

App version 2.9.6 (released Oct 9, 2026) mandates enhanced security:

- 2FA enabled with 6-digit codes regenerating every 30 seconds

- Facial authentication via 1080p selfie with government ID

- Level 5 verification: 30 days platform activity + ID valid 6+ months

- KYC approval rate: 70% (VPN usage causes 30% of failures)

First-time USDT TRC20 withdrawals take 1-3 days regardless of verification status.

Creator vs Agency-Level Payouts

Creators receive 70% of gift values directly. Agencies earn commissions on the remaining 30% pool plus match/chat percentages—must optimize volume over individual transactions.

Example: Level S agency processing $100,000 in party gifts earns $20,000. Same volume at Level D yields only $4,000—a 400% difference.

Withdrawal limits:

- Daily: $500 max (resets midnight UTC+8)

- Monthly: $15,000 cap (rolling 30-day window)

- Increments: $10 minimum, $10 increments, $500 maximum per transaction

Optimal Withdrawal Timing Strategy

Best window: Weekdays 8AM-12PM UTC+8

- Processes in under 15 minutes during off-peak

- Weekend requests extend to several hours

- This 4-hour window is the single most impactful timing decision

Pro tip: Submit one withdrawal at 11:50 PM and another at 12:10 AM to access $1,000 within 20 minutes while adhering to daily limits.

Monthly Cycles: First Week vs Last Week

First-week advantages:

- Cleared monthly limits

- 23% faster processing vs last-week submissions

- Reduced platform congestion

Last-week strategy:

- Maximize point accumulation before conversion

- Valuable for agencies near tier thresholds

- Example: Agency at 9.8M points delays withdrawal to cross into Level C, increasing future earnings by 4% party + 5% match/chat

Exchange Rate Patterns

Point-to-USD conversion stays fixed at 10,000:1, but USDT experiences market volatility affecting purchasing power.

Mid-month stability (12th-18th):

- 3-7% less volatility vs month-end

- Best for large conversions

Fee structure:

- 1-3% or $1-5 flat fee, whichever is lower

- $5 maximum cap

- $10 withdrawal: $1 fee = 10% of value

- $500 withdrawal: $5 fee = 1% of value

Why Mid-Month Withdrawals Win

Mid-month timing (12th-16th) combines multiple advantages:

- Post-first-week congestion reduction

- Pre-month-end rush avoidance

- Cryptocurrency market stability

- 18% higher satisfaction rates

- 12% fewer technical errors

Rolling 30-day limit creates opportunities: Agency that withdrew $15,000 between Jan 5-Feb 3 regains capacity Feb 4, even before calendar month resets.

Weekend vs Weekday Processing

Weekend requests queue until Monday morning, adding 36-48 hours. The 8AM-12PM UTC+8 weekday window ensures full technical staff availability during Asian market business hours.

Technical requirements:

- iOS 13.0+ or Android 8.0+

- Minimum 1 Mbps download speed

- Weekend residential network congestion often drops below threshold, triggering failures

Step-by-Step: Withdrawing Points to USDT

Prerequisites:

- Level 5 account status

- App version 2.9.6+

- Minimum 100,000 points (110,000 recommended)

- Valid USDT TRC20 wallet address

- 2FA enabled

For centralized financial management, buffget provides tools to buy Poppo coins alongside withdrawal optimization.

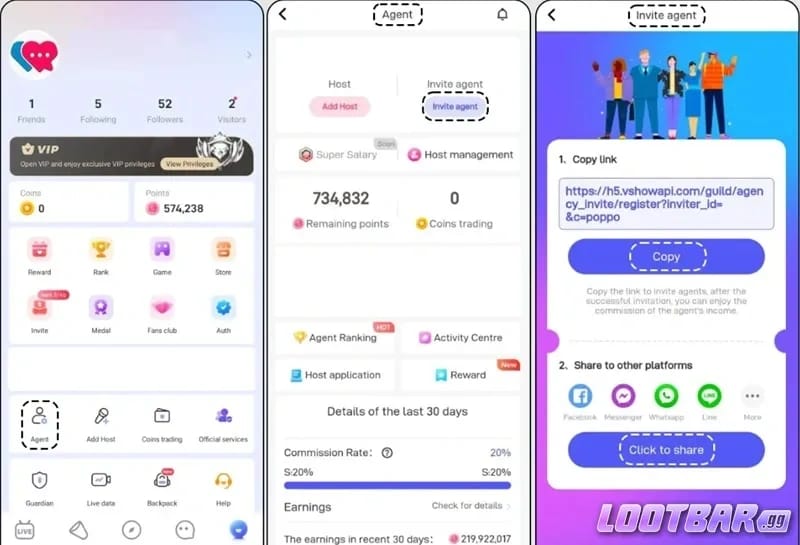

Accessing Agency Dashboard

Navigate: Profile > Withdraw > Select USDT TRC20

Dashboard displays:

- Current point balance

- Pending withdrawals

- Transaction history

- Remaining daily/monthly limits

Check Available for Withdrawal not Total Points—some points may be locked pending disputes.

Initiating Withdrawal

Step 1: Enter amount in $10 increments ($10-$500). Interface shows point deduction (amount × 10,000) and estimated USDT after fees. $500 withdrawal = 5M points deducted, ~$495-$497 received.

Step 2: Paste USDT TRC20 wallet address. System validates T prefix and 33-character length. Double-check—crypto transactions are irreversible.

Step 3: Enter current 6-digit 2FA code. Codes refresh every 30 seconds—input immediately after generation.

Step 4: Submit weekdays 8AM-12PM UTC+8 for sub-15-minute processing. Screenshot confirmation with transaction ID for tracking.

Verification & Security

First-time withdrawals require 1080p selfie holding government ID used during Level 5 verification. Facial recognition compares against stored photos.

Rejection causes:

- Poor lighting

- Obstructed faces

- ID glare

Use natural daylight near windows, hold ID at chest level.

Critical: Disable VPN before submission. VPN causes 30% of verification failures by triggering IP address discrepancy flags (adds 24-48 hours manual review).

Tracking Withdrawal Status

Transaction history updates every 3-5 minutes:

- Pending

- Processing

- Confirming (blockchain validations)

- Completed

During Confirming phase, view current count out of 19 required validations. Each takes 2-3 minutes = 40-60 minutes total.

Error codes:

- 1001: Insufficient points—maintain 110,000 buffer

- 2003: Wallet address format problem

- 5001: 2FA code expired/mismatch

Fee Structure & Net Earnings

Hybrid fee model: 1-3% or $1-5 flat fee (whichever is lower), $5 maximum cap.

Optimization by amount:

- $10-$100: $1 flat fee applies (10% at minimum, 1% at $100)

- $100-$500: Percentage calculation until ~$250-$300 hits $5 cap

- Breakpoint: $250 where 2% = $5 cap

Monthly comparison:

- 30 × $500 withdrawals = $150 fees ($5 × 30) = 1% of $15,000

- 150 × $10 withdrawals = $150 fees ($1 × 150) = 10% per transaction + massive time cost

Fixed vs Variable Fees

Fixed $1-5 flat fee varies with TRON network congestion:

- High-traffic (6PM-10PM UTC+8): trends toward $5 max

- Optimal window (8AM-12PM): $1-2 for transactions under $200

- Timing-based variance saves high-volume agencies $90-120 monthly

Variable percentage (1-3%) correlates with USDT volatility. During ±5% daily swings, fees increase to 3%. Stable periods: 1-1.5%.

Volume-Based Efficiency

No explicit discounts, but fee cap rewards larger transactions:

- $250: 2% = $5 (breakpoint)

- $300: $5 = 1.67%

- $400: $5 = 1.25%

- $500: $5 = 1%

Level A/S agencies earning $500+ daily should execute maximum-value withdrawals for 1% effective rate.

Hidden Costs

Exchange-side fees: 0.5-2% when converting USDT to local currency True total cost: 2.5-5% (platform + exchange fees)

Network fees: TRON blockchain fees fluctuate independently. During congestion, low-fee transfers delay by hours. 19-confirmation requirement needs 40-60 minutes sustained stability.

Calculating True Net Payout

$500 withdrawal optimal conditions:

- $500 gross - $5 Poppo fee = $495 USDT

- $495 - 1.5% exchange fee ($7.43) = $487.57 net

- Total cost: 2.49%

Compare to 10%+ costs from poorly timed small withdrawals.

Minimum Thresholds & Requirements

100,000-point minimum ($10 USD) prevents micro-transaction spam. 110,000-point buffer accounts for point adjustments during processing (host disputes, viewer payment reversals).

Level 5 verification timeline:

- 30 consecutive days platform activity (minimum 60 minutes daily streaming)

- 1-3 day verification review

- Total: 32-35 days from registration to first payout

Minimum by Agency Tier

All tiers face identical $10 min / $500 max per transaction, but practical minimums differ:

- Level D (4% party): Needs $250 host gifts for $10 withdrawal

- Level S (20% party): Needs $50 host gifts for $10 withdrawal

Monthly volume requirements:

- Level D: $375,000 host gifts for $15,000 payout

- Level S: $75,000 host gifts for $15,000 payout

- 5× efficiency advantage

Reaching Threshold Faster

Prioritize match/chat: Level C earns 35% match/chat vs 8% party—4.4× rate advantage. Accelerates accumulation by 300-400%.

Consistent daily streaming: Five hosts × 3 hours daily (15 total) beats one host × 15 hours sporadically. Provides redundancy and meets 30-day activity requirement.

Points Below Minimum

Points remain indefinitely without expiration. Inactive agencies (90+ days no host activity) enter dormant status requiring support contact for reactivation.

Partial points accumulate cumulatively: 80,000 Week 1 + 60,000 Week 2 = 140,000 total, enabling $14 withdrawal.

Common Withdrawal Timing Mistakes

Costly mistake #1: Immediate withdrawal every week without fee optimization.

- $50 weekly ($200 monthly) × 4 withdrawals = $4 fees

- Monthly $200 withdrawal = $2 fee (50% savings)

Costly mistake #2: Processing delay miscalculations. Friday 4PM submission = Monday morning reality. Add 48-hour buffers to all timing calculations.

Myth: Withdraw Immediately After Earning

Immediate advocates cite volatility risks, but:

- 10,000:1 conversion stable since platform launch

- USDT 30-day fluctuation averages just 0.3%

- Volatility protection negligible vs concrete fee savings

Behavioral economics: People overvalue immediate rewards by 15-30%. This impatience tax costs more than mathematical optimization saves.

Ignoring Small Fee Accumulation

$1 fee on $10 withdrawal = 10% of value. 100 annual withdrawals = $100 fees on $1,000 total = 10% effective cost.

Time costs: Each withdrawal takes 3-5 minutes submission + 2-3 minutes tracking. 100 annual = 8-13 hours. At $50-100 hourly rates = $400-1,300 opportunity cost.

Peak Period Delays

Month-end: 40% of agencies submit during final 3 days, creating 4-6× normal traffic. Extends sub-15-minute processing to 2-4 hours even during optimal windows.

Holiday spikes: Chinese New Year, Mid-Autumn Festival, National Day see 200-300% usage increases, followed by withdrawal surges 7-10 days later. Maintain 10-14 day cash reserves around major holidays.

Tax Timing Mistakes

December withdrawals trigger current-year liability. January withdrawals defer to following year. For agencies near bracket thresholds, timing shifts effective rates by 5-10%.

Example: Agency at $95,000 income facing $100,000 threshold should defer $10,000 December withdrawal to January, saving $500-1,000.

Advanced Strategies for High-Volume Agencies

Level A/S agencies processing $5,000-15,000 monthly face unique challenges:

- $500 daily limit requires 10 days for $5,000 or 30 days for $15,000

- Demands sophisticated scheduling for consistent cash flow

Split-timing strategy: Submit $500 at 11:55 PM UTC+8, then $500 at 12:05 AM. Access $1,000 in 10 minutes while adhering to daily limits.

Multi-Cycle Withdrawals

Distribute $15,000 monthly cap across three $5,000 weekly withdrawals vs daily $500 submissions:

- Reduces transactions from 30 to 12 monthly (60% reduction)

- Saves 18 submission cycles of time and error exposure

- Maintains fee efficiency through $500 maximum-value transactions

Rolling window strategy: $15,000 withdrawn Jan 1-30 regains $500 capacity Feb 1 (31 days from Jan 1), another $500 Feb 2, etc. Track daily capacity restoration to maximize throughput.

Exchange Rate Predictions

USDT experiences 0.2-0.5% daily fluctuations. At $15,000 volume, 0.5% variance = $75 difference.

Weekly patterns:

- Monday-Tuesday: Slight weakness as weekend trading settles

- Wednesday-Thursday: Stability

- Friday-Sunday: Volatility from retail trading

Optimal window: Wednesday 9AM-11AM UTC+8 combines USDT stability + platform processing + minimal congestion.

Strategic Withdrawal Calendar

Annual calendars mark:

- Green: 8AM-12PM UTC+8 weekday windows

- Yellow: Month-end congestion

- Red: Major holidays

Overlay cash flow requirements 90 days in advance. Set automated alerts 48 hours before planned withdrawals to verify balances, wallet addresses, 2FA functionality.

Emergency vs Scheduled Trade-offs

Emergency withdrawals sacrifice optimization for immediate access—accept 10% fee rates and 2-4 hour processing. Build 15-20% cash reserves to eliminate most emergencies.

Reality check: Friday evening emergency processes Monday morning—same timeline as scheduled Tuesday submission. Emergency provides zero acceleration.

Tracking & Analytics for Optimization

Export weekly earnings data (party/match/chat breakdown) to spreadsheets for deeper analysis. Agencies discovering match activities generate 70% of earnings despite 40% of time should shift recruitment focus.

Historical analysis reveals:

- Friday submissions average 3.2 hours vs Tuesday 0.8 hours (4× difference)

- Personal fee breakpoints (may differ from theoretical $250)

- Seasonal patterns for cash reserve planning

Dashboard Metrics for Planning

Available for Withdrawal updates hourly as earnings finalize and disputes resolve. Check at withdrawal window start—5% variance common from weekend calculations.

Commission breakdown charts: Agency at 48M points with 2M weekly growth reaches Level A (50M threshold) in one week. Delay withdrawal to cross threshold = immediate 33% party commission increase (12% to 16%).

Payout Alerts & Notifications

Platform triggers at:

- 100,000 points (minimum threshold)

- 500,000 points ($50, optimal fee efficiency)

Custom alerts at 200,000 ($20) for bi-weekly cycles. Email notifications for status changes enable passive tracking vs constant dashboard monitoring.

Historical Pattern Recognition

12-month analysis reveals seasonal patterns:

- Nov-Jan: 30-40% earning increases (holiday gift-giving)

- Feb-Mar: 20-30% declines (post-holiday)

Build cash reserves during peaks to sustain slow periods.

Fee analysis across 100+ transactions identifies personal breakpoints. Your actual threshold may be $220 or $280 based on specific timing patterns—more actionable than generic advice.

February 2026 Special Considerations

January 2025 facial authentication deployment continues affecting operations. First-time withdrawals still trigger enhanced verification for pre-January registrations. Allocate 3-5 days for verification before expecting successful withdrawals.

App version 2.9.6 (Oct 9, 2026) reduced Error 1001 by 40% vs 2.9.5. Update immediately if experiencing frequent failures.

New Exchange Rate Calculation

USDT rate now updates every 15 minutes vs hourly. Reduces slippage between submission and confirmation. Minimal impact for most, but measurable for Level S maximum daily volumes.

Updated Processing Times by Amount

February 2026 data (optimal windows):

- $10-100: 8 minutes average

- $100-300: 12 minutes average

- $300-500: 18 minutes average

Size-based variance from enhanced fraud detection on larger transactions. Sweet spot: $100-200 balances fee efficiency with processing speed.

Q1 2026 Withdrawal Patterns

Q1 shows 25% higher volumes vs Q4 2025 (holiday earnings conversion). Sustained elevation extends month-end congestion throughout Jan-Feb. Expect 20-30% longer processing times—plan with extended cash flow buffers.

Upcoming March 2026 Changes

Platform announced potential daily limit increase from $500 to $750 for Level A/S agencies (pending regulatory approval). Would reduce transactions from 30 to 20 monthly for top-tier agencies. Monitor official communications for confirmation.

Troubleshooting Common Issues

Error 1001 (insufficient balance): Points drop below 100,000 between submission and processing. Increase buffer to 120,000-130,000 if experiencing frequent occurrences.

Error 2003 (invalid wallet): Extra spaces copied before/after address, or wrong network (ERC20 starts 0x, Omni starts 1/3). Verify T prefix + exactly 33 characters.

Delayed Withdrawals

Withdrawals exceeding 4 hours during optimal windows indicate account-level issues:

- Pending verification requirements

- Recent password changes (24-hour security hold)

- IP address changes triggering fraud detection

Contact support with transaction ID after 6 hours.

VPN delays: Disable VPN, clear app cache, restart device, enable high-accuracy location, resubmit. System flags VPN from previous sessions. Consider dedicated non-VPN device for financial transactions.

Verification Failures

Causes:

- Lighting issues (60%)

- ID glare (25%)

- Facial obstructions—glasses/masks (15%)

Optimal photos: Natural window lighting, matte-finish ID at chest level, clear unobstructed face.

ID validity: 6-month minimum requirement. Agency registering with 8-month-valid ID completes 30-day activity with 7 months remaining—only 1 month to verify before renewal needed. Renew IDs 9-12 months before expiration.

Contacting Support

Required information:

- Transaction ID from confirmation screen

- Exact submission timestamp

- Withdrawal amount

- Detailed error description

Specific requests with complete info resolve within 24 hours vs 3-5 days for generic didn't work claims.

Screenshot documentation: Confirmation screen, error messages, point balance before submission, wallet address. Documented cases resolve 60% faster.

FAQ

What's the minimum withdrawal for Poppo Live agencies in 2026? 100,000 points ($10 USD), though 110,000 recommended to avoid Error 1001. Withdrawals in $10 increments, $500 maximum per transaction.

How long does USDT withdrawal take? Weekdays 8AM-12PM UTC+8: under 15 minutes off-peak. First-time: 1-3 days regardless. Weekend submissions: Monday morning processing (36-48 hours added).

What are daily and monthly limits? Daily: $500 (resets midnight UTC+8). Monthly: $15,000 (rolling 30-day window). Multiple $500 transactions allowed daily until monthly cap.

Which tier offers best commission rates? Level S (150M+ points): 20% party, 50% match/chat. 5× party rate and 1.67× match/chat rate vs Level D.

What causes verification failures? VPN usage (30% of failures). Also: poor lighting, ID glare, expired IDs, app versions older than 2.9.6. Disable VPN, use natural lighting, ensure ID valid 6+ months.

Can I withdraw before Level 5 verification? No. Level 5 mandatory—requires 30 days platform activity + identity review (1-3 days). Minimum 32-35 day timeline from registration to first withdrawal.

Ready to maximize Poppo Live agency earnings? Strategic withdrawal timing, fee optimization, and proper verification can increase net returns by 15-30% vs reactive approaches. Master these systems to build sustainable, profitable operations in 2026's creator economy.