Poppo Live Coin Seller Margins: 10-30% Profit Truth

Buffget

2026/02/01

Understanding Poppo Live Coin Reselling: The 2026 Landscape

Coin reselling involves buying virtual currency at wholesale rates and redistributing at marked-up prices outside official channels—a gray market parallel economy.

The system works through point-to-coin exchanges: 100,000 points convert to 92,000-95,000 coins. Since 10,000 points = $1 USD, this creates pricing advantages versus official rates of 9,460 coins per dollar.

For legitimate purchases without reselling risks, Poppo Live coins top up through buffget provides authorized transactions with competitive pricing and account security.

Entry barriers are substantial: $500 minimum ongoing balance, $2,000 initial recharge or $6,000 stored coins, plus managing 5+ active hosts broadcasting 6+ hours weekly.

What Defines Coin Reselling in Poppo Live Ecosystem

Resellers function as intermediaries purchasing coins through unofficial channels and redistributing to discount-seeking users. The business model exploits the 92,000-95,000 coins per 100,000 points conversion—a 6.5% advantage over official channels.

Registration requires: downloading Poppo App, copying Poppo ID from profile, clicking agency registration links, entering ID for verification codes, and submitting verification (processes in 10-15 minutes).

Technical requirements: app version 2.9.6+, iOS 12.0+/Android 5.0+, minimum 1 Mbps internet (mandatory from Sept 28, 2025). Facial authentication became mandatory Jan 2025 for users 18+.

The Gray Market Economy: How Unauthorized Sellers Operate

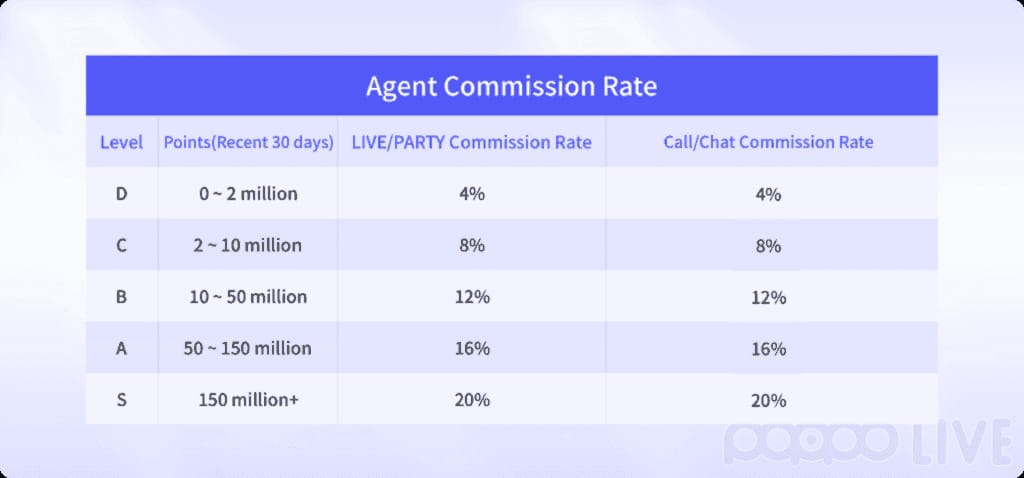

Tiered agency structures determine profit potential:

- Level D (0-2M points): 4% Party commissions, 30% Match/Chat

- Level S (150M+ points): 20% Party commissions, 50% Match/Chat

Revenue extends beyond coin sales. Daily ranking rewards distribute $180 to top performers. Gold tier agents ($65,000+ monthly sales) access premium commission structures.

Compliance monitoring is strict—two consecutive weeks of non-compliance triggers suspension.

Why Reselling Appeals to Entrepreneurs and Users

Tiered profit claims attract sellers:

- Bronze (500+ coins monthly): $50-150 profit

- Silver (2,000+ coins monthly): $200-600 profit

- Gold (10,000+ coins monthly): $6,500-19,500 profit

For buyers, agency rates offer apparent savings: 458,000 coins for $50 versus 430,000 coins officially—a 6.5% advantage.

The $100 minimum top-up via Epay/USDT creates barriers, making resellers accepting smaller transactions appealing to casual spenders.

Market Size and Competition Analysis for 2026

Market saturation has reached critical levels. The 5,000,000+ coin balance requirement to unlock agent logos creates visible status markers intensifying competition.

Price wars compress margins. Theoretical 10-30% margins face downward pressure to 7-14% as sellers undercut competitors. Customer acquisition costs have risen substantially as organic discovery saturates.

Poppo Live Coin Seller Profit Margin: Breaking Down the Numbers

Actual margins reveal gaps between advertised earnings and realized income. The 10-30% margin assumes zero operational costs—unrealistic for functioning operations.

Example: purchasing 458,000 coins at $50 wholesale, reselling at $53.50 official equivalent yields $3.50 gross margin (7%). This ignores transaction fees, payment processing, customer acquisition, and risk premiums.

For transparent pricing without hidden risks, cheap Poppo Live coins through buffget provide clear cost structures with authorized compliance.

Tiered profit structures create misleading expectations:

- Bronze $50-150 monthly requires $333-$1,000 gross sales

- Silver $200-600 requires $1,333-$4,000 gross sales

- Gold $6,500-19,500 requires $43,333-$130,000 gross sales

Typical Acquisition Costs: Where Resellers Source Inventory

100,000 points ($10) convert to 92,000-95,000 coins, creating acquisition cost of $0.0105-$0.0109 per coin versus official $0.0001057 per coin.

Initial capital requirement: $2,000 one-time recharge or $6,000 stored coins. Coins expire after 3 months inactivity, forcing constant transaction velocity.

Minimum withdrawal: $10 at 100,000 point multiples, processed Sundays 23:59 UTC+8. Weekly settlement cycles tie up working capital.

Retail Pricing Strategies and Markup Percentages

Resellers typically price 5-8% below official rates—enough discount to attract buyers while maintaining margins.

Common strategy: offer 458,000 coins for $48 (versus $50 agency cost), creating $2 buyer savings and $2 gross profit (4% margin). Compressed margins reflect competitive pressure.

Premium pricing targets convenience-seeking buyers willing to pay near-official rates for faster service or flexible payment methods.

Transaction and Payment Processing Fees

Payment processing consumes 2-5% of transaction value. Cryptocurrency (USDT) offers lower fees but introduces exchange rate volatility.

Chargeback risks add $15-$100 per incident. High chargeback rates trigger payment processor terminations.

Currency conversion costs affect international operations, consuming 1-3% of transaction value.

Hidden Costs That Erode Profit Margins

Customer service scales with transaction volume—time investment for solo operators, paid staff for scaled operations.

Marketing and acquisition costs have risen. Sellers invest 10-20% of revenue in advertising, social media, or affiliate commissions.

Risk premiums for account suspension require backup accounts, diversified inventory, and operational security—adding complexity without generating revenue.

Real Profit Margin Calculations: Three Scenario Models

Low-Volume Reseller: Monthly Profit Analysis

Bronze tier (500 coins monthly) at advertised $50-150 profit requires $333 gross sales.

Revenue:

- Gross sales: $333

- Acquisition cost ($0.0108/coin): $270

- Gross profit: $63

Expenses:

- Payment processing (3%): $10

- Customer acquisition (10%): $33

- Time (5 hours at $15/hour): $75

- Platform compliance: $10

Net result: -$65 monthly loss

Bronze operations rarely achieve profitability. Time and infrastructure costs exceed gross margins.

Medium-Scale Operation: Scaling Challenges and Returns

Silver tier (2,000 coins monthly) at advertised $200-600 profit requires $2,667 gross sales (midpoint).

Revenue:

- Gross sales: $2,667

- Acquisition cost: $2,160

- Gross profit: $507

Expenses:

- Payment processing (3%): $80

- Customer acquisition (8%): $213

- Time (20 hours at $20/hour): $400

- Infrastructure: $50

- Risk reserve (5%): $133

Net result: -$369 monthly loss

Even at medium scale, operational costs consume gross margins.

High-Volume Seller: Maximum Profit Potential and Risk Exposure

Gold tier (10,000+ coins monthly) at advertised $6,500-19,500 profit requires $65,000 gross sales.

Revenue:

- Gross sales: $65,000

- Acquisition cost: $54,167

- Gross profit: $10,833

Expenses:

- Payment processing (2.5%): $1,625

- Customer acquisition (5%): $3,250

- Staff (2 full-time at $3,000/month): $6,000

- Infrastructure: $500

- Risk reserve (10%): $6,500

Net result: -$7,042 monthly loss

High-volume operations face greatest risk exposure. $65,000+ monthly sales trigger enhanced platform scrutiny. Single account termination with $6,000 inventory creates catastrophic losses.

Break-Even Point: When Does Reselling Become Profitable?

Profitability requires:

- Volumes exceeding 15,000-20,000 coins monthly

- Customer acquisition costs below 3%

- Personal time valued at below-market rates

- Accepting 20-30% account suspension risk

- Multiple backup accounts and inventory diversification

These requirements explain why most resellers fail despite attractive headline claims.

The Risk Factor: Why Profit Margins Don't Tell the Full Story

Poppo Live Platform Policies on Unauthorized Coin Sales

Platform prohibits unauthorized coin reselling. Two consecutive weeks of non-compliance triggers immediate suspension. Violations include failing to maintain minimum host activity (5 hosts at 6+ hours weekly), falling below balance thresholds ($500 ongoing), or suspicious transaction patterns.

Facial authentication (Jan 2025) complicates multi-account operations. Technical requirements (app 2.9.6+, iOS 12.0+/Android 5.0+, 1 Mbps internet from Sept 28, 2025) create ongoing maintenance burdens.

Account Suspension and Permanent Ban Consequences

Suspension immediately freezes all stored inventory. With $500-$6,000 balance requirements, single suspension eliminates months of profits.

Permanent bans result in total inventory loss—no compensation or refunds. Sellers with 5,000,000+ coin balances face $50,000+ losses in single ban actions.

Customer relationships evaporate with termination. Sellers lose all contact information and transaction history.

Detection Methods: How Poppo Identifies Reselling Activity

Algorithms monitor for:

- High-frequency coin transfers to multiple unique IDs

- Consistent pricing patterns suggesting commercial operations

- Correlation between purchases and immediate redistribution

3-month coin expiration forces transaction velocity creating detectable patterns. Cross-referencing host activity requirements versus transaction volumes reveals inconsistencies.

Financial Losses from Confiscated Inventory and Frozen Accounts

Frozen accounts trap pending withdrawals. Sunday weekly withdrawal schedule means substantial accumulated points become unrecoverable.

Customer refund obligations compound losses. Sellers refund customers while losing already-transferred inventory—doubling transaction losses.

Reputational damage limits future earning potential.

Market Saturation and Competition Pressure in 2026

Increased Reseller Competition Driving Margins Down

New entrant volume accelerates as low-barrier opportunities attract passive income seekers. $2,000-$6,000 capital requirement remains accessible versus $50,000+ traditional business startups.

Visibility of tiered profit claims attracts continuous new seller influx. Theoretical 10-30% margins contract to 5-15% in competitive markets, with desperate sellers operating at 3-7%.

Price Wars and Race-to-Bottom Dynamics

Transparent digital pricing enables instant comparison shopping, forcing destructive price competition.

The 6.5% structural advantage from agency rates establishes ceiling on sustainable discounting. Deeper discounts operate at negative margins.

Volume-based commissions incentivize aggressive pricing to reach higher tiers, but increased transactions don't offset reduced unit margins.

Customer Acquisition Costs in Crowded Markets

Organic discovery is nearly impossible. New sellers invest $20-30 per customer through advertising. At $50 average transaction with 5% margin ($2.50 profit), sellers need 8-12 repeat purchases to recover acquisition costs.

Retention marketing adds 5-10% to operational expenses without generating direct revenue.

Sustainability Concerns for Long-Term Profitability

Platform enforcement intensifies with improved detection algorithms, biometric authentication, and stricter compliance monitoring.

Buyer sophistication increases as scam awareness spreads. Users prefer authorized channels despite higher costs.

Regulatory scrutiny on virtual currency transactions expands globally, creating compliance burdens informal resellers cannot address.

Legal and Ethical Considerations for Coin Reselling

Terms of Service Violations and Legal Implications

Unauthorized reselling violates Poppo Live's terms of service—breach of contract providing legal foundation for account termination and inventory confiscation.

Some jurisdictions classify virtual currency reselling as unlicensed money transmission requiring regulatory approvals. Operators face potential fines, cease-and-desist orders, or criminal charges.

Tax implications: reselling income constitutes taxable business revenue requiring proper reporting. Many fail to maintain documentation, creating tax evasion liability.

Consumer Protection Issues for Buyers

Buyers lack consumer protection mechanisms available through official channels. No recourse for non-delivery, account issues, or disputes.

Coin expiration policy (3 months inactivity) creates risks. Resellers rarely disclose coins may carry expiration dates.

Account security risks emerge when sharing Poppo IDs. Malicious operators exploit ID information for account takeover, phishing, or identity theft.

Fraud Risks and Chargeback Problems

Fraudulent sellers collect payment without delivering coins or use stolen payment methods resulting in transaction reversals.

Chargeback abuse: unethical buyers claim non-delivery after receiving coins, exploiting dispute mechanisms. Creates 5-10% loss rates for sellers.

Lack of transaction verification makes resolving disputes impossible.

Regulatory Scrutiny on Virtual Currency Reselling

Financial regulators classify virtual currency transactions as money services business requiring licensing, anti-money laundering compliance, and customer identification programs.

Consumer protection agencies monitor for deceptive practices and false advertising.

Tax authorities employ data analytics to identify unreported business income. Digital transaction trails make detection increasingly likely.

Common Misconceptions About Poppo Coin Reselling Profits

Myth: Easy Money with Minimal Effort

Maintaining 5 active hosts at 6+ hours weekly, monitoring compliance, managing customers, and processing transactions requires 15-30 hours weekly.

Automation limitations prevent passive operation. Customer service demands human judgment, compliance requires active oversight.

Learning curve extends 3-6 months while operating at negative or minimal margins.

Myth: Sustainable Long-Term Business Model

Platform policy evolution trends toward stricter enforcement. Jan 2025 facial authentication and ongoing technical updates demonstrate platform commitment to controlling unauthorized reselling.

Market saturation creates unsustainable competitive dynamics. As seller numbers increase while buyer demand remains static, per-seller volumes decline.

Single terms of service update could eliminate entire business model overnight.

Myth: Low Risk with High Returns

Risk-return profile inverts traditional models. High-return Gold tier scenarios carry proportionally higher risks.

Account suspension probability increases with volume. Bronze tier faces 10-15% annual risk; Gold tier faces 40-60% annual risk.

Total loss scenarios occur regularly—immediate inventory loss with zero recovery potential.

Reality Check: Success Rate and Failure Statistics

70-80% of new resellers abandon operations within 6 months. Of remaining 20-30% persisting beyond 6 months, only 5-10% achieve sustainable profitability exceeding minimum wage equivalent.

Successful minority possesses unique advantages: established customer networks, technical automation skills, regional arbitrage opportunities, or willingness to accept legal/ethical risks.

Survivorship bias distorts perception—visible successful sellers promote achievements while silent majority of failures disappear.

Legitimate Alternatives: Higher Profit, Lower Risk Strategies

Official Poppo Live Creator Monetization Programs

Creator programs provide multiple revenue streams. Broadcasters earn through gift exchanges where viewers purchase coins officially and send virtual gifts converting to broadcaster earnings.

Earnings scale with audience engagement, not capital investment. Unlike reselling requiring $2,000-$6,000 upfront, broadcasting requires time, creativity, and audience-building. Successful creators achieve $1,000-$10,000+ monthly without inventory risk.

Platform support includes promotional features, algorithm visibility, and partnership opportunities.

Broadcasting Revenue: Earning Through Content Creation

Revenue derives from viewer gifts, subscriptions, and platform bonuses. $180 daily ranking rewards provide additional income beyond viewer contributions.

Content creation builds transferable skills and audiences—personal brands, content libraries, fan communities retaining value despite policy changes.

Diversification opportunities expand with growth: multi-platform presence, merchandise, sponsorships, coaching programs.

Gift Exchange Optimization for Broadcasters

Viewers purchase coins at official rates (9,460 coins per dollar) and send gifts. Broadcasters receive percentage-based payouts varying by tier and gift type.

Strategic streaming schedules align with peak viewer activity. Data-driven optimization increases average revenue per hour from $5-10 for beginners to $50-100+ for established creators.

Viewer relationship cultivation drives sustainable gift revenue through emotional investment.

Affiliate and Partnership Opportunities Within Platform Guidelines

Official affiliate programs allow earning commissions by referring new users or promoting features—operating within terms of service.

Partnership opportunities for high-performers include sponsored content, exclusive event hosting, and ambassador roles offering fixed compensation plus performance bonuses.

Cross-promotion networks enable collaborative audience building and revenue sharing.

Safe Coin Purchasing: Why Authorized Channels Matter

Risks of Buying from Unauthorized Resellers

Unauthorized resellers can't guarantee coin source legitimacy. Coins may originate from compromised accounts or fraudulent payment methods. Recipient accounts face suspension risk.

Transaction disputes lack resolution mechanisms. Buyers have no recourse for non-delivery or incorrect quantities.

Personal information exposure creates security vulnerabilities—account takeover attempts, phishing, identity theft.

Benefits of Official Top-Up Services

Official channels guarantee legitimate coin sources that won't trigger security flags. Platform-authorized transactions maintain full account standing.

Buyer protection includes transaction verification, dispute resolution, and customer support access.

Transparent pricing eliminates hidden fees or surprise charges.

How buffget Provides Secure, Legitimate Coin Purchases

Buffget operates as authorized top-up service providing platform-compliant purchases with competitive pricing, transaction security, and account protection.

Fast delivery through established platform relationships ensures coins arrive within minutes. Automated processing eliminates delays while maintaining security protocols.

Dedicated support teams assist with questions, resolve issues promptly, and provide purchasing guidance.

Price Comparison: Official vs Unauthorized Sources

Official pricing: 9,460 coins per dollar. Unauthorized resellers offer 5-10% discounts (10,000-10,500 coins per dollar). Apparent savings disappear when accounting for transaction risks and fraud exposure.

Buffget's authorized pricing offers 2-4% savings versus direct platform purchases—reflecting legitimate operational efficiencies, not policy-violating arbitrage.

Total cost analysis favors authorized services when incorporating risk factors. 7% unauthorized discount becomes negative value with 10% suspension probability.

Final Verdict: Is Poppo Live Coin Reselling Profitable in 2026?

Comprehensive analysis reveals coin reselling profitability remains elusive for 70-80% of participants. Theoretical 10-30% margins create negative returns in operational reality.

Weighing Potential Profits Against Real Risks

Maximum Gold tier scenarios ($6,500-19,500 monthly) require $65,000+ transaction volumes, 40+ hours weekly, $6,000+ capital at risk, and accepting 40-60% annual suspension probability. This compares unfavorably to legitimate employment or conventional business.

Asymmetric risk structure creates casino-like economics where catastrophic losses (total inventory confiscation) offset accumulated small gains. Expected value calculations yield negative returns.

Opportunity cost: 20-40 hours weekly could produce $800-$3,200 monthly through conventional employment at $10-20 hourly without capital risk.

Who Might Succeed vs Who Will Likely Fail

Potential success candidates: established customer networks, technical automation skills, high risk tolerance, willingness to operate in legal gray areas. Even for this minority, success remains uncertain and unsustainable.

Likely failure candidates: those attracted by passive income claims, limited capital unable to absorb losses, expecting quick returns, uncomfortable with terms violations.

Mathematical reality: if 1,000 sellers compete for $100,000 monthly market demand, average per-seller revenue equals $100—insufficient for any participant to achieve advertised profits.

Recommended Action Steps for Different User Types

Aspiring sellers: Avoid coin reselling entirely. High capital requirements, substantial time investment, significant risk exposure, and low probability of sustainable profitability create unfavorable conditions. Pursue legitimate creator monetization programs.

Current sellers: Conduct honest profitability analysis incorporating all costs, time at market wages, and risk premiums. If revealing negative/minimal returns, exit before catastrophic losses. Transition to legitimate platform strategies.

Coin buyers: Exclusively use authorized services like buffget providing transaction security, account protection, and buyer support. 5-10% savings from unauthorized resellers carry disproportionate risks. Authorized services' reliability justifies marginal price premiums.

Future Outlook: Platform Crackdowns and Market Evolution

Platform enforcement trends indicate intensifying crackdowns. Jan 2025 facial authentication, Sept 2025 connectivity mandates, and ongoing technical updates demonstrate systematic efforts to control gray market operations.

Detection technology improvements enable sophisticated pattern recognition. Machine learning analyzing transaction patterns will increase suspension rates.

Regulatory evolution will impose additional compliance burdens. Governments implementing stricter oversight on digital asset transactions create mounting legal risks.

Inevitable outcome: consolidation toward authorized channels and elimination of unauthorized reselling as viable business model.

Frequently Asked Questions

What is the average profit margin for Poppo Live coin resellers in 2026?

Advertised margins: 10-30% on user sales, 7-14% on agent transactions. Actual net margins after payment processing, customer acquisition, time investment, compliance expenses, and risk reserves: -5% to +8%. Majority operate at negative net margins when properly accounting for all costs.

Is it legal to resell Poppo Live coins for profit?

Occupies legal gray areas varying by jurisdiction. Not explicitly illegal in most regions but violates Poppo Live's terms of service (breach of contract). Some jurisdictions classify high-volume reselling as unlicensed money transmission requiring regulatory approval. Tax obligations apply to all reselling income—non-compliance creates tax evasion liability.

How much can you earn reselling Poppo coins monthly?

Tiered structures: Bronze (500+ coins) $50-150, Silver (2,000+ coins) $200-600, Gold (10,000+ coins) $6,500-19,500. These represent gross profits before operational expenses. Realistic net earnings after all costs: negative returns for Bronze/Silver, $500-2,000 monthly for Gold tier—doesn't justify capital risk, time investment, or policy violation exposure.

Does Poppo Live ban accounts for coin reselling?

Yes. Platform actively enforces policies against unauthorized reselling. Two consecutive weeks of violations trigger suspension. Detection of reselling activity results in termination with inventory confiscation. Suspension probability: 10-15% annually for low-volume, 40-60% annually for high-volume Gold tier. Banned accounts lose all stored coins without compensation or appeal.

What are the risks of buying coins from unauthorized sellers?

Account suspension if coins originate from policy-violating sources, transaction fraud when sellers fail to deliver, personal information exposure enabling account takeover, lack of buyer protection or dispute resolution, potential receipt of coins with hidden expiration dates. Risks far outweigh 5-10% cost savings versus authorized channels.

How does buffget differ from unauthorized coin sellers?

Buffget operates as authorized top-up service providing platform-compliant purchases with guaranteed legitimate sourcing, transaction security, account protection, fast automated delivery, professional customer support, transparent pricing, and buyer protection. Unlike unauthorized resellers violating platform policies and exposing buyers to account risks, buffget maintains full compliance ensuring safe transactions preserving account standing.

Ready to purchase Poppo Live coins safely? Skip unauthorized reseller risks and choose buffget—the trusted, authorized top-up service with competitive rates, instant delivery, and complete account protection. Get your coins now through buffget and enjoy peace of mind with every transaction.